Xero¶

The Xero modules allow you to watch, create, update, list, and/or delete accounts, bank transfers, bank transactions, change history, contacts, contact groups, credit notes, employees, files, invoices, items, journal manuals, notes, payments, purchase orders, and tax rates in your Xero account.

Prerequisites

- A Xero account

In order to use Xero with Ibexa Connect, it is necessary to have a Xero account. If you do not have one, you can create a Xero account at https://www.xero.com/signup/.

Caution

The module dialog fields that are displayed in bold (in the Ibexa Connect scenario, not in this documentation article) are mandatory!

Connecting Xero to Ibexa Connect¶

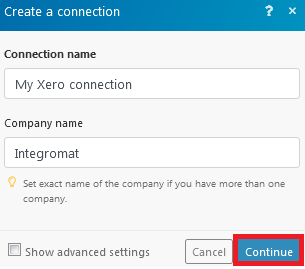

1. Go to Ibexa Connect and open the Xero module's Create a connection dialog.

2. In the Connection name field, enter a name for the connection.

3. In the Company name field, enter the company name if you have more than one company.

4. Click Continue.

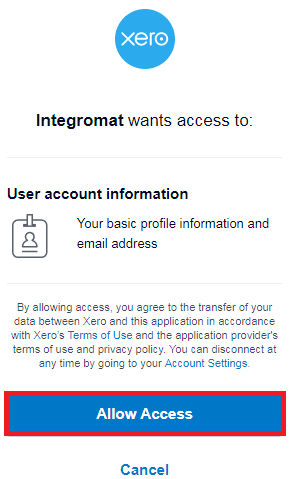

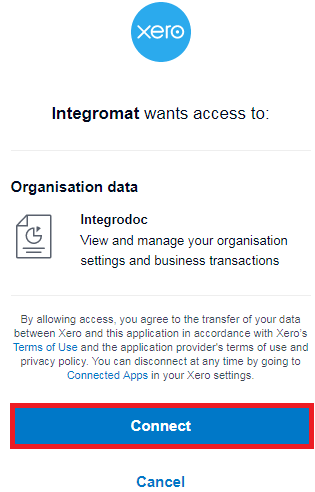

5. Confirm the dialogue box by clicking the Allow Access button.

6. Confirm the dialogue box by clicking the Connect button.

The connection has been established.

Invoices¶

Watch Invoices¶

Triggers when an invoice is added or updated.

Required Permissions: accounting.transactions, accounting.settings

| Filter | Enter the location where you want to watch the invoices. For example, Type=="BANK" |

Search for Invoices¶

Searches for an invoice.

Required Permissions: accounting.transactions, accounting.settings

Search by |

Select the option to search the invoices:

|

Maximum number of returned accounts |

The maximum number of invoices Ibexa Connect should return during one scenario execution cycle. |

Get an Invoice¶

Returns information about an invoice with a given ID.

Required Permissions: accounting.transactions, accounting.settings

| Invoice ID | Enter the Invoice ID whose details you want to retrieve. |

Create an Invoice¶

Creates a new invoice.

Required Permissions: accounting.transactions, accounting.contacts, accounting.settings

Type |

Select the type of invoice you want to create:

|

Contact ID |

Enter or Search the Contact ID to whom you want to attach the invoice. |

Line Items |

Add the line items: Description Enter the details of the item. Quantity Enter the number of items. Unit amount Enter the number of items. Item Select the item. Account Code Select the category to which the item belongs. Tax Code Select the tax code applicable for the item:

Tax Amount Enter the amount of tax for the item. Line Amount Enter the item amount after the discount. Discount Rate Enter the discount rate of the item. Discount Amount Enter the discount amount for the item. Tracking Add the tracking name of the item. |

Date |

Enter the date the invoice is issued. |

Due date |

Enter the date the invoice is due. |

Line amount type |

Enter the amount excluding taxes. |

Invoice number |

Enter the invoice number. |

Reference |

Enter the reference number. This is applicable only for sale invoices. |

Branding Theme |

Select the branding theme for the invoice. |

URL |

Enter the URL to the source document of the invoice. |

Currency code |

Select the currency code applicable to the invoice. |

Currency rate |

Enter the currency conversion rate. |

Status |

Select the status of the invoice:

|

Sent to Contact |

Select the Yes if the invoice in the Xero app should be marked as "sent". This can be set only on invoices that have been approved. |

Expected Payment Date |

Enter the date when the payment for the invoice is expected. This is available only on sales invoices. |

Planned payment date |

Enter the date when the payment for the invoice is planned. This is available only on bills. |

Update an Invoice¶

Updates an invoice by ID.

Required Permissions: accounting.transactions, accounting.contacts, accounting.settings

Invoice ID |

Enter the Invoice ID you want to update. |

Type |

Select the type of invoice you want to create:

|

Contact ID |

Enter or Search the Contact ID to whom you want to attach the invoice. |

Line Items |

Add the line items: Description Enter the details of the item. Quantity Enter the number of items. Unit amount Enter the number of items. Item Select the item. Account Code Select the category to which the item belongs. Tax Code Select the tax code applicable for the item:

Tax Amount Enter the amount of tax for the item. Line Amount Enter the item amount after the discount. Discount Rate Enter the discount rate of the item. Discount Amount Enter the discount amount for the item. Tracking Add the tracking name of the item. |

Date |

Enter the date the invoice is issued. |

Due date |

Enter the date the invoice is due. |

Line amount type |

Enter the amount excluding taxes. |

Invoice number |

Enter the invoice number. |

Reference |

Enter the reference number. This is applicable only for sale invoices. |

Branding Theme |

Select the branding theme for the invoice. |

URL |

Enter the URL to the source document of the invoice. |

Currency code |

Select the currency code applicable to the invoice. |

Currency rate |

Enter the currency conversion rate. |

Status |

Select the status of the invoice:

|

Send to contact |

Select Yesif you want to send this invoice to a contact:

|

Expected Payment Date |

Enter the date when the payment for the invoice is expected. This is available only on sales invoices. |

Planned Payment Date |

Enter the date when the payment for the invoice is planned. This is available only on bills. |

Get an Invoice URL¶

Retrieves a Xero online invoice URL.

Required Permissions: accounting.transactions, accounting.settings

| Invoice ID | Enter the Invoice ID whose URL you want to retrieve. |

Send an Invoice via Email¶

The email will be sent to the primary email address of the contact on the invoice. The invoice must be of Type ACCREC and a valid Status for sending (SUBMITTED, AUTHORISED, or PAID).

Required Permissions: accounting.transactions, accounting.settings

| Invoice ID | Enter the Invoice ID whose details you want to send via email. |

Bank Transactions¶

Watch Bank Transactions¶

Triggers when bank transactions are added or updated.

Required Permissions: accounting.transactions, accounting.settings

| Filter | Enter the location where you want to watch the invoices. For example, Type=="BANK" |

Get a Bank Transaction¶

Returns information about a transaction with a specified ID.

Required Permissions: accounting.transactions, accounting.settings

| Bank Transaction ID | Enter the Bank Transaction ID whose details you want to retrieve. |

Create a Bank Transaction¶

Creates a new bank transaction.

Required Permissions: accounting.transactions, accounting.contacts, accounting.settings

Type |

Select the type of bank transaction you want to create:

|

Contact ID |

Enter the Contact ID who is performing the bank transaction. |

Line items |

Add the line items: Description Enter the details of the item. Quantity Enter the number of items. Unit amount Enter the number of items. Item Select the item. Account Code Select the category to which the item belongs. Tax Code Select the tax code applicable for the item:

Tax Amount Enter the amount of tax for the item. Line Amount Enter the item amount after the discount. Discount Rate Enter the discount rate of the item. Discount Amount Enter the discount amount for the item. Tracking Add the tracking name of the item. |

Bank Account |

Select the bank account whose transaction you are performing. |

Is Reconciled |

Select if this transaction is reconciled. |

Date |

Enter the date of the transaction. |

Reference |

Enter the transaction reference number. |

Currency Code |

Select the currency code in which you are performing the transaction. |

Currency Rate |

Enter the applicable currency conversion rate. |

URL |

Enter the URL to the source document. |

Line Amount Type |

Select the line amount type:

|

Bank Transfers¶

Watch Bank Transfers¶

Triggers when a new bank transfer is created.

Required Permissions: accounting.transactions, accounting.settings

| Filter | Enter the location where you want to watch the invoices. For example, Type=="BANK" |

Create a Bank Transfer¶

Transfers a specified amount from one account to another.

Required Permissions: accounting.transactions, accounting.settings

| From bank account | Select the bank account from which you want to transfer. |

| To bank account | Select the bank account to which you want to transfer. |

| Amount | Enter the amount you want to transfer. |

| Date | Enter the date of the transfer. |

Contacts¶

Watch Contacts¶

Triggers when a contact is created or updated.

Required Permissions: accounting.contacts, accounting.settings

| Filter | Enter the location where you want to watch the invoices. For example, Type=="BANK" |

Search for Contacts¶

Searches for a contact by name or email.

Required Permissions: accounting.contacts, accounting.settings

Search by |

Select the option to search the contacts:

|

Maximum number of returned accounts |

The maximum number of contacts Ibexa Connect should return during one scenario execution cycle. |

Get a Contact¶

Retrieves contact information by ID.

Required Permissions: accounting.contacts, accounting.settings

| Contact ID | Enter the contact ID whose details you want to retrieve. |

Create a Contact¶

Creates a new contact.

Required Permissions: accounting.transactions, accounting.contacts, accounting.settings

Name |

Enter the name of the contact you want to create. |

Contact number |

Enter the phone number of the contact. |

Account number |

Enter the account number of the contact. |

First name |

Enter the first name. |

Last name |

Enter the last name. |

Enter the email address of the contact. |

|

Skype |

Enter the Skype ID of the contact. |

Contact persons |

Add the contact persons: First name Enter the first name of the contact person. Last name Enter the last name of the contact person. Enter the email address of the contact person. Include in emails Select Yes if you want to include the contact person in your emails:

|

Bank account details |

Enter the bank account details of the contact. |

Tax number |

Enter the tax number. |

Accounts receivable tax type |

Select the accounts receivable tax type for the contact:

|

Accounts payable tax type |

Select the accounts payable tax type for the contact:

|

Addresses |

Add the address of the contact: Type Select the type of address:

Address line 1 Enter the street address. Address line 2 Enter the street address. Address line 3 Enter the street address. Address line 4 Enter the street address. City Enter the city name. Region Enter the area name. Postal Code Enter the postal code of the area. Country Enter the country name. Attention to Enter the name to whom you are addressing. |

Phones |

Add the phone numbers of the contact: Type Select the type of phone number.

Number Enter the phone number. Area Code Enter the area code. Country Code Enter the country code. |

Default Currency |

Select the applicable currency for the contact. |

Xero Network Key |

Enter the Xero Network Key to store the contact. |

Sales default account |

Select the sales category of the contact. |

Purchases default account |

Select the purchasing category of the contact. |

Payment terms |

Select the payment terms applicable for the contact:

|

Update a Contact¶

Updates a contact by ID.

Required Permissions: accounting.transactions, accounting.contacts, accounting.settings

Contact ID |

Enter the Contact ID you want to update. |

Name |

Enter the name of the contact. |

Contact number |

Enter the phone number of the contact. |

Account number |

Enter the account number of the contact. |

First name |

Enter the first name of the contact. |

Last name |

Enter the last name of the contact. |

Enter the email address of the contact. |

|

Skype |

Enter the Skype ID of the contact. |

Contact persons |

Add the contact persons: First name Enter the first name of the contact person. Last name Enter the last name of the contact person. Enter the email address of the contact person. Include in emails Select Yes if you want to include the contact person in your emails:

|

Bank account details |

Enter the bank account details of the contact. |

Tax number |

Enter the tax number of the contact. |

Accounts receivable tax type |

Select the accounts receivable tax type for the contact:

|

Accounts payable tax type |

Select the accounts payable tax type for the contact:

|

Addresses |

Add the address of the contact: Type Select the type of address:

Address line 1 Enter the street address. Address line 2 Enter the street address. Address line 3 Enter the street address. Address line 4 Enter the street address. City Enter the city name. Region Enter the area name. Postal Code Enter the postal code of the area. Country Enter the country name. Attention to Enter the name to whom you are addressing. |

Phones |

Add the phone numbers of the contact: Type Select the type of phone number.

Number Enter the phone number. Area Code Enter the area code Country Code Enter the country code. |

Default currency |

Select the applicable currency for the contact. |

Xero network key |

Enter the Xero Network Key to store the contact. |

Sales default account |

Select the sales category of the contact. |

Purchases default account |

Select the purchasing category of the contact. |

Payment terms |

Select the payment terms applicable for the contact:

|

Archive a Contact¶

Archive a contact with a given ID.

Required Permissions: accounting.contacts, accounting.settings

| Contact ID | Enter the Contact ID you want to archive. |

Credit Notes¶

Watch Credit Notes¶

Triggers when a credit note is added or updated.

Required Permissions: accounting.transactions, accounting.settings

| Filter | Enter the location where you want to watch the invoices. For example, Type=="BANK" |

Get a Credit Note¶

Returns information about a credit note with a specified ID.

Required Permissions: accounting.transactions, accounting.settings

| Credit Note ID | Enter the Credit Note ID whose details you want to retrieve. |

Create a Credit Note¶

Creates a new credit note.

Required Permissions: accounting.transactions, accounting.settings

Type |

Select the type of credit note you are creating:

|

Contact ID |

Enter the Contact ID whose credit notes you are creating. |

Line items |

Add the line items: Description Enter the details of the item. Quantity Enter the number of items. Unit amount Enter the number of items. Item Select the item. Account Code Select the category to which the item belongs. Tax Code Select the tax code applicable for the item:

Tax Amount Enter the amount of tax for the item. Line Amount Enter the item amount after the discount. Discount Rate Enter the discount rate of the item. Discount Amount Enter the discount amount for the item. Tracking Add the tracking name of the item. |

Status |

Select the status of the credit note:

|

Line Amount Type |

Select the line amount type of the credit note:

|

Date |

Enter the date when the credit note is issued. |

Currency Rate |

Enter the currency conversion rate. |

Currency Code |

Select the currency code applicable for the credit note. |

Credit Note Number |

Enter the credit note number. |

Reference |

Enter the reference number of the credit note. |

Branding Theme |

Select the branding theme for the credit note. |

Manual Journals¶

Watch Manual Journals¶

Triggers when a manual journal is created or updated.

Required Permissions: accounting.transactions

| Filter | Enter the location where you want to watch the invoices. For example, Type=="BANK" |

Search for Manual Journals¶

Searches for a manual journal.

Required Permissions: accounting.transactions, accounting.settings

Search by |

Select the option to search the manual journals:

|

Maximum number of returned accounts |

The maximum number of manual journals Ibexa Connect should return during one scenario execution cycle. |

Get a Manual Journal¶

Returns information about a manual journal.

Required Permissions: accounting.transactions, accounting.settings

| Manual Journal ID | Enter the Manual Journal ID whose details you want to retrieve. |

Create a Manual Journal¶

Creates a manual journal.

Required Permissions: accounting.transactions, accounting.settings

Narration |

Enter the description of the journal. |

Journal lines |

Add the journal lines: Line amount Enter the amount after the discount. Accounts Select the category applicable to the journal. Description Enter the details of the journal. Tax type Select the tax type for the journal:

Tracking Add the tracking name for the journal. |

Date |

Enter the journal posting date. |

Line amount type |

Select the line amount type:

|

Status |

Select the status of the journal:

|

URL |

Enter the URL link of the source document. |

Show on cash basis reports |

Select Yesif you want to show the journal based on cash basis report:

|

Items¶

Create an Item¶

Creates a new item.

Required Permissions: accounting.settings

| Code | Enter the item code. |

| Account | Enter the account for which you are creating the item. |

| Name | Enter the name of the item. |

| Is sold | Select if the item is available for sales transactions. |

| Is purchased | Select if the item is available for purchase transactions. |

| Description | Enter sales details of the item. |

| Purchase description | Enter the purchase details of the item. |

| Unit price | Enter the single unit purchasing price of the item. By default, the price rounded off for two decimals. |

| Cost of goods sold account | Select the goods sold account. |

| Tax | Select the applicable tax for the item. |

| Unit price | Enter the sale unit price of the item. |

| Account | Select the account category of the item. |

| Tax | Select the applicable tax for the item. |

Update an Item¶

Updates an item by ID.

Required Permissions: accounting.settings accounting.settings

| Item ID | Enter the Item ID you want to update. |

| Code | Enter the item code. |

| Account | Enter the account for which you are creating the item. |

| Name | Enter the name of the item. |

| Is sold | Select if the item is available for sales transactions. |

| Is purchased | Select if the item is available for purchase transactions. |

| Description | Enter sales details of the item. |

| Purchase description | Enter the purchase details of the item. |

| Unit price | Enter the single unit purchasing price of the item. By default, the price is rounded off to two decimals. |

| Cost of goods sold account | Select the goods sold account. |

| Tax | Select the applicable tax for the item. |

| Unit price | Enter the sale unit price of the item. |

| Account | Select the account category of the item. |

| Tax | Select the applicable tax for the item. |

Get an Item¶

Searches for an item by item ID or item code.

Required Permissions: accounting.settings

| Item ID | Enter the Item ID whose details you want to retrieve. |

Payments¶

Watch Payments¶

Triggers when a payment is created or updated.

Required Permissions: accounting.transactions, accounting.settings

| Filter | Enter the location where you want to watch the payments. For example, Type=="BANK" |

Get a Payment¶

Retrieves information about a payment with a specified ID.

Required Permissions: accounting.transactions, accounting.settings

| Payment ID | Enter the Payment ID whose details you want to retrieve. |

Create a Payment¶

Creates a new purchase order.

Required Permissions: accounting.transactions, accounting.settings

Specify object by |

Select the option for which you want to create the payment:

|

Account |

Select the account to be used for payment. |

Amount |

Enter the payment amount. |

Date |

Enter the date when the payment is being made. |

Reference |

Enter the details of the payment. |

Is reconciled |

Select Yes if the payment is reconciled:

|

Purchase Orders¶

Watch Purchase Orders¶

Triggers when an order is added or updated.

Required Permissions: accounting.transactions, accounting.settings

| Filter | Enter the location where you want to watch the purchase orders. For example, Type=="BANK" |

Get a Purchase Order¶

Returns information about a purchase order with a specified ID.

Required Permissions: accounting.transactions, accounting.settings

| Purchase Order ID | Enter the Purchase Order ID whose details you want to retrieve. |

Create a Purchase Order¶

Creates a new purchase order.

Required Permissions: accounting.transactions, accounting.contacts, accounting.settings

Contact ID |

Enter the Contact ID whose purchase order you are creating. |

Line Items |

Add the line items: Description Enter the details of the item. Quantity Enter the number of items. Unit amount Enter the number of items. Item Select the item. Account Code Select the category to which the item belongs to. Tax Code Select the tax code applicable for the item:

Tax Amount Enter the amount of tax for the item. Line Amount Enter the item amount after the discount. Discount Rate Enter the discount rate of the item. Discount Amount Enter the discount amount for the item. Tracking Add the tracking name of the item. |

Date |

Enter the purchase order issuing date. |

Delivery Date |

Enter the goods delivering date. |

Line Amount Type |

Select the line amount type:

|

Purchase Order Number |

Enter the purchasing order number. |

Reference |

Enter the additional reference number. |

Branding Theme |

Select the branding theme for the purchasing order. |

Currency Code |

Select the currency code applicable for the purchasing order. |

Status |

Select the status of the purchase order:

|

Sent to Contact |

Select Yes if you send the purchase order to a contact:

|

Delivery Address |

Enter the address where the goods should be delivered. |

Attention to |

Enter the person to whom you are delivering the goods. |

Telephone |

Enter the phone number. |

Delivery Instructions |

Enter the delivery instructions, if any. |

Expected Arrival Date |

Enter the date when the goods are expected to arrive at the address. |

Contact Groups¶

Get a Contact Group¶

Returns information about a contact group.

Required Permissions: accounting.contacts, accounting.settings

| Contact Group ID | Enter the Contact Group ID whose details you want to retrieve. |

Create a Contact Group¶

Creates a contact group.

Required Permissions: accounting.contacts, accounting.settings

| Contact Group ID | Enter the Contact Group ID you want to create. |

Delete a Contact Group¶

Deletes all contacts from a contact group.

Required Permissions: accounting.contacts, accounting.settings

| Contact Group ID | Enter the Contact Group ID you want to delete. |

Add a Contact to a Contact Group¶

Adds a contact to a specified contact group.

Required Permissions: accounting.contacts, accounting.settings

| Contact Group | Select the contact group to which you want to add a contact. |

| Contact ID | Enter the Contact ID to add to the contact group. |

Remove a Contact from a Contact Group¶

Removes a contact from a contact group.

Required Permissions: accounting.contacts, accounting.settings

| Contact Group | Select the contact group to which you want to remove a contact. |

| Contact ID | Enter the Contact ID that you want to remove from the contact group. |

Employees¶

Create an Employee¶

Creates a new employee.

Required Permissions: accounting.settings

| First name | Enter the first name of the employee. |

| Last name | Enter the last name of the employee. |

| External link | Enter any external link available about the employee. For example, a link to the employee record. |

Update an Employee¶

Updates an employee by ID.

Required Permissions: accounting.settings

| Employee ID | Enter the Employee ID whose details you want to update. |

| First name | Enter the first name of the employee. |

| Last name | Enter the last name of the employee. |

| External link | Enter any external link available about the employee. For example, a link to the employee record. |

Reports¶

Get a Bank Summary¶

Returns the balance and cash movements for each bank account.

Required Permissions: accounting.reports.read, accounting.settings

| From Date | Enter the start date from which you want to get the bank summary. |

| To Date | Enter the last date until which you want to get the bank summary. |

Get a Bank Statements Report¶

Returns bank statements for a selected bank account.

Required Permissions: accounting.reports.read, accounting.settings

| Bank account | Select the bank account whose statement summary report you want to retrieve. |

| From Date | Enter the start date from which you want to get the bank statement. |

| To Date | Enter the last date from which you want to get the bank statement. |

Reports¶

Search for Accounts¶

Finds an account by ID, name, or code.

Required Permissions: accounting.settings

Search by |

Select the option to search the tax rates:

|

Maximum number of returned accounts |

The maximum number of accounts Ibexa Connect should return during one scenario execution cycle. |

Get an Account¶

Returns information about an account with a specified ID.

Required Permissions: accounting.settings

| Account ID | Enter the Account ID whose details you want to retrieve. |

Files¶

Upload a File¶

Uploads a file to a selected object.

Required Permissions: accounting.attachments, accounting.settings

Where to send the file |

Select the option to send the file:

|

Invoice ID |

Enter the Invoice ID to which you want to send file. |

Credit Note ID |

Enter the Credit Note ID to which you want to send the file. |

Bank Transaction ID |

Enter the Bank Transaction ID to which you want to send the file. |

Bank Transfer ID |

Enter the Bank Transfer ID to which you want to send the file. |

Contact ID |

Enter the Contact ID to which you want to send the file. |

Manual Journal ID |

Enter the Manual Journal ID to which you want to send the file. |

Purchase Order ID |

Enter the Purchase Order ID to which you want to send the file. |

File name |

Enter the file name you are uploading. For example, sample.txt. |

Data |

Enter the path of the file to upload. |

Tax Rates¶

Search for Tax Rates¶

Finds a tax rate by name.

Required Permissions: accounting.settings

Search By |

Select the option to search the tax rates:

|

Maximum number of returned accounts |

The maximum number of tax rates Ibexa Connect should return during one scenario execution cycle. |

History of Changes¶

Get History of Changes¶

Retrieves the changes made to a given object.

Required Permissions: accounting.transactions, accounting.contacts, accounting.settings

Object |

Select the object whose change history you want to retrieve:

|

Object ID |

Enter the Object ID whose change history you want to retrieve. |

Create a History Note¶

Adds a note to a record.

Required Permissions: accounting.transactions, accounting.contacts, accounting.settings

Object |

Select the object whose note you want to create:

|

Object ID |

Enter the Object ID. |

Details |

Enter the note text. |

Other¶

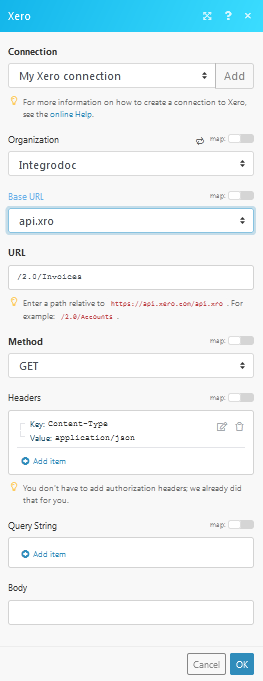

Make an API Call¶

Performs an arbitrary authorized API call.

Organization |

Select the organization for which you are making the API call. |

Base URL |

Select the endpoint URL to connect to your Xero account. |

URL |

Enter a path relative to For the list of available endpoints, refer to the Xero API Documentation. |

Method |

Select the HTTP method you want to use:

|

Headers |

Enter the desired request headers. You don't have to add authorization headers; we already did that for you. |

Query String |

Enter the request query string. |

Body |

Enter the body content for your API call. |

Example - List Invoices¶

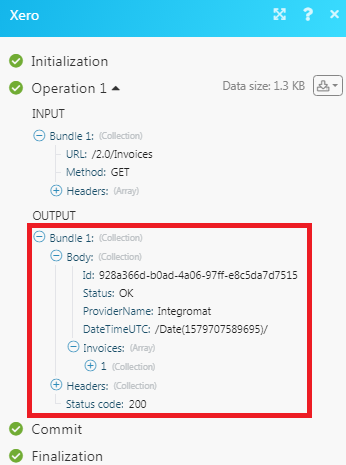

Following API call returns all invoices:

Matches of the search can be found in the module's Output under Bundle > Body > Invoices.

In our example, 1 invoice was returned:

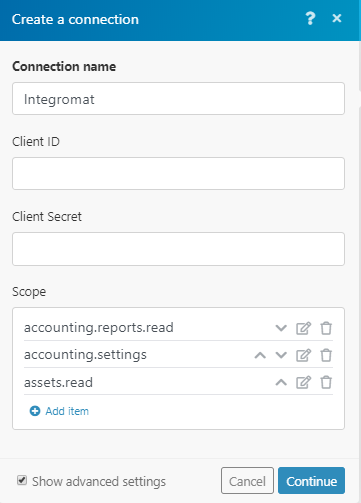

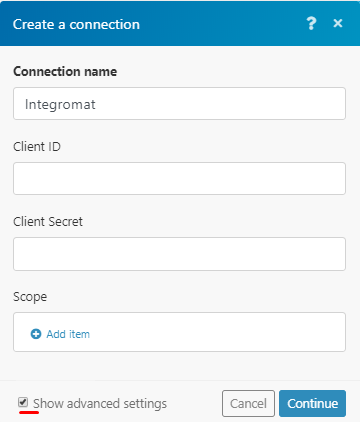

Adding Scopes

If you would like to be able to get access to certain documents such as the balance sheet you will need to add the necessary scopes listed here Xero scopes.

To be able to do so you will need to create a new connection and tick on the Show advanced settings:

1. In the Scope section, click the Add item button.

2. Add the scopes that you require to work with.

3. Click the Continue button to connect to your Xero account.